Who uses kdb+? What's kdb+ used for?

Who uses kdb+? What do they use it for? Why do they use kdb? What is kdb+

These are typically the first questions most people ask when they find out about this niche database and language.

Contents

- Who uses kdb+

- Top European Users

- Top American Users

- What do they use kdb+ for?

Who uses kdb+?

Top European Users

- barclays capital

- deutsche bank

- ubs ag

- bank of america

- jpmorgan chase & co.

- citigroup

- morgan stanley group inc.

- the royal bank of scotland

- hsbc bank plc

- devnet

- kb rubin ltd.

- rsj a.s.

- first derivatives

- bank of tokyo-mitsubishi ufj ltd.

- knight capital europe limited

Top American Users

- bank of america

- citigroup

- barclays capital

- citicorp global information network

- jpmorgan chase & co.

- deutsche bank

- fidelity investments

- ubs ag

- millenium partners l.p.

- rbc capital markets corporation

- sun trading llc

- sac capital advisors llc

- schonfeld tools llc.

- royal bank of canada

- state street imswest

- alliancebernstein l.p.

- knight capital group inc

- bny brokerage

- fxcm

- the bank of new york mellon corporation

What do they use kdb+ for?

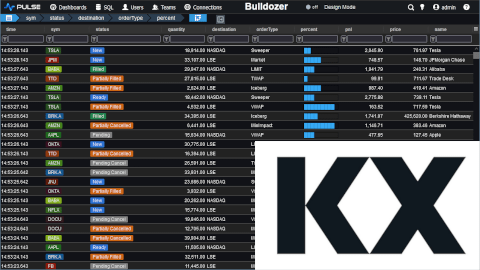

Market/Tick Data Storage

Some firms have moved to kdb+ as their enterprise wide tick storage system and have built up large teams around this, Three of these include:

| Firm | Project | Description |

|---|---|---|

| Barclays | BATS | Barclays Algorithmic Trading System. Distributed multi-server kdb+tick like setup, with support for multiple asset classes, credit, FX, fixed income. "BATS achieves the seamless integration with existing manual trading systems and allows deployments of new strategies without interrupting the trading flow." |

| Morgan Stanley | Horizon | "The Horizon system provides a holistic time series infrastructure using a single database technology, KDB+/Q, with consistent tools for data acquisition/loading, data quality, and production support that covers a broad range of asset classes, data types, and frequencies that meet current and future trading, analytical and operational needs for all MS users." |

| JP Morgan | TicDB | TicDB captures and stores market data for equities/futures in all markets

across the globe, efficient access is made available to clients globally and real time and historical analytics are provided.

"The team currently supports over 60 clients within various lines of business in the investment bank. These real-time and historical analytics are central to our products, which provide clients with intelligent analytical tools in the pre-trade, intraday and post-trade phases of trading.." |

What Else?

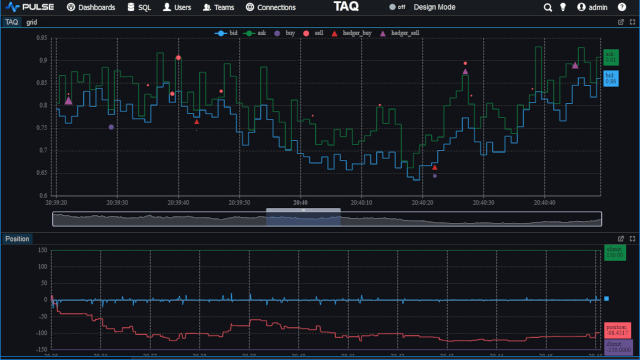

Once a lot of the data within the firm is stored in kdb+, systems are built ontop of these: pre/post trade analytics, strategy implementations, backtesting frameworks, electronic trading...

- BAML - Electronic Trading, particularly FX.

- RBS - FX analytics.