August 16th, 2024 by Ryan Hamilton

DolphinDB and TimeStored working in partnership. Customization of qStudio can be found here.

Contents below.

DolphinDB, a leading provider of the real-time platform for analytics and stream processing, and TimeStored, a pioneering company in the field of data visualization and analytics, are proud to announce a partnership focused on advancing data visualization in quantitative finance. With an emphasis on integrating DolphinDB’s capabilities into TimeStored’s flagship products, qStudio and Pulse, this partnership aims to deliver innovative enhancements to complex analysis scenarios including quantitative trading, high-frequency backtesting, and risk management.

In the competitive field of quantitative trading, a high level of precision in data analysis is essential. Rivals are constantly striving to boost productivity and efficiency to obtain a competitive edge in the dynamic financial markets. To meet this challenge, DolphinDB is committed to providing cutting-edge real-time analytics tools to people worldwide. It offers a unified platform with over 1500 built-in features and a collection of stream computing engines for data warehouse, analytics, and streaming applications. Because of its exceptional efficiency in investment research, DolphinDB has emerged as a significant technology pillar in key areas including strategic research, risk control, and measurement platforms.

Data visualization is intrinsically intertwined with data analysis, serving as an indispensable partner in the exploration of complex datasets and the extraction of valuable insights. By deeply integrating DolphinDB’s efficient investment research capabilities with TimeStored’s advanced visualization technology, we have constructed a scenario which can intuitively display complex financial data. By transforming abstract financial data into intuitive charts and indicators, we significantly enhanced the readability of information and the efficiency of decision-making. It not only meets the current financial market’s demand for data transparency and immediacy but also provides a powerful analysis and decision-support platform for financial professionals. This empowers them to quickly seize opportunities and effectively manage risks in the volatile market.

The latest update to qStudio introduces powerful new features: DolphinDB syntax highlighting, code completion, and a server tree view. These enhancements significantly streamline developers’ workflow, offering intuitive coding and improved navigation. Moreover, the partnership has enabled the visualization of DolphinDB data within TimeStored’s Pulse product. It opens up new horizons for users interested in streaming data visualization, enabling a dynamic and interactive approach to analyzing real-time data.

This partnership leverages the technological strengths of both companies to revolutionize data management. DolphinDB and Timestored are committed to delivering the top-tier solutions for data analysis and quantitative investment research experience to global market participants.

About DolphinDB

Founded in 2016, DolphinDB is committed to providing users worldwide with cutting-edge real-time analytics platforms. Our flagship product, DolphinDB, offers a unified platform for data warehouse, analytics, and streaming workloads. At its core, it is a high-performance distributed time-series database. With a fully featured programming language, over 1500 built-in functions, and a suite of stream computing engines, DolphinDB enables rapid development of high-performance applications for mission-critical tasks in global financial institutions.

As an enterprise-focused real-time analytics provider, we take pride in enabling organizations to unlock the value of big data and make smarter decisions through real-time insights into their most demanding analytical workloads.

About TimeStored

TimeStored specializes in real-time interactive data tools, offering robust solutions since 2013. Their products, like Pulse and qStudio, support a wide array of databases and enhance data analysis capabilities. Pulse enables the creation of real-time interactive dashboards, facilitating collaborative data visualization. qStudio, a free SQL analysis tool, features an intelligent SQL editor with functionalities like syntax highlighting and code completion, aimed at improving the efficiency and effectiveness of data analysts.

October 3rd, 2023 by admin

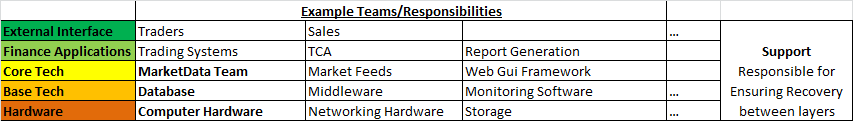

We just announced a unique event that gathers 4 of the newest, most advanced databases for Finance into 1 hour:

If you work on big data in Finance, this is your chance to get an overview of the rapidly changing database landscape. TimeStored will be organizing a free online presentation, each database company will present 10 minutes on what is unique to their solution. Bringing together the top new technologies together in one place.

Tuesday 24th October – 2-3PM UK

SIGN UP NOW

September 15th, 2023 by admin

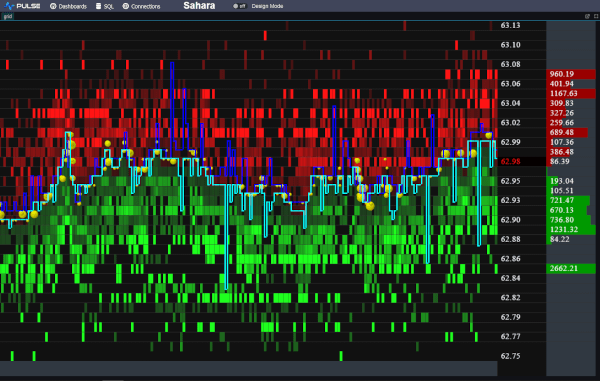

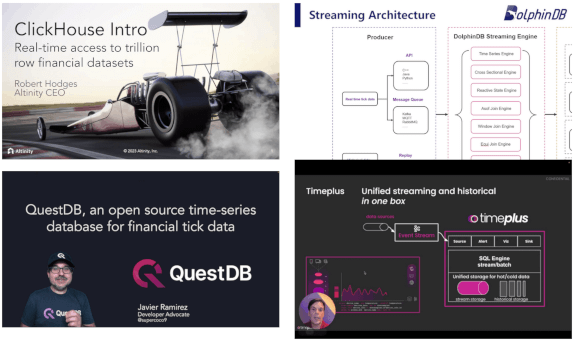

We want to be the best finance streaming visualization solution. To achieve that, we can’t just use off the shelf parts, we have built our own market data order book visualization component from scratch, it’s only dependency is webgl. We call it DepthMap. It plots price levels over time, with the shading being the amount of liquidity at that level. It’s experimental right now but we are already receiving a lot of great feedback and ideas.

Faster Streaming Data

A lot of our users were capturing crypto data to a database, then polling that database. We want to remove that step so Pulse is faster and simpler. The first step is releasing our Binance Streaming Connection. In addition to our existing kdb streaming connection, we are trialling Websockets and Kafka. If this is something that interests you , please get in touch.

February 16th, 2023 by Ryan Hamilton

This article is (part 2) of a series. See the previous post on “2018 – The Future of Tech in Banks, particularly within Market Data“.

The previous article described a few problems with the current tech/finance structure in most banks. In the words of Jim Barksdale:

“there are two ways to make money. You can bundle, or you can unbundle.”

In this case we can see two possible solutions:

- Horizontal Integration – Providing a bundled reliable layer e.g. AWS to solve your hardware needs

- Vertical Integration – Providing a front to back solution, SAAS – Software-As-A-Service e.g. github hosting, third-party trading platform.

Horizontal Integration AWS – To Solve hardware layer

Consider the example of outsourcing: “AWS for hardware”, it makes 100% sense, there is very little customization or unknown capability with 95%+ of servers for application use within a bank being fairly standard. The area where this currently becomes problematic is high-performance and co-location, to cover those needs hybrid-cloud could help. The benefits and savings in other areas, security/reliability/costs can often out weight the drawbacks. In my opinion most internal cloud solutions will dissapear within the next few years.

Benefits of Bundling/Outsourcing

Solutions rely on the problem being well known/understood and that all inputs/outputs to the bound box can be well defined. They work by:

- Preventing duplication of effort – Designed to be re-used

- Reducing communication overhead – Everything within their box is a service with APIs or configurable. No meetings/Change tickets required (OK less. There will always be change tickets!).

- Preventing misalignment and Misalignment of incentives -One entity is responsible for full delivery and if outsourced can be scaled up or down at little overhead/risk to the bank.

Vertical Integration – Outsourced Market Data-As-A-Service

An example of vertical integration would be “Market Data-As-A-Service”. If every bank has the same market data problem and we can get the benefits of buying that bundle, should we?

The danger is that it takes years to evolve to an “API” that covers 95% of the needs and even then you have to be careful that you don’t over allocate resources on something that the user actually has little value for. This is harder to know as an external entity as you don’t sit with the customer.

So given that banks have 3 options:

– Keep separate teams

– Use horizontal solutions

– Use vertical solutions

What should they do? When?

Ultimately it will be a combination of parts that evolve over time but if the problem is shared by all banks the solution is using off-the-shelf software eventually.

The market-data/feeds team should at all times be asking:

- Should we build this?

- Is this a problem specific to this bank that will add value?

- Or is it a general problem where we can take advantage of economies of scale?

Conclusion

Outsourced Solutions for Market Data – currently make less sense. As:

– Even if we can outsource storage of market data, we need a way to store our own trade date and other internal data sets.

– Column Oriented Storage – is becoming a commoditized technology. A number of firms including the major ones such as AWS are bringing user friendliness, reliability and general availability of what used to be a niche technology.

– Over recent years, firms including HFT have captured a lot of value by having in-depth market data knowledge.

The market data teams should begin to learn redshift/google/AWS solutions for as they scale to all firms everywhere the savings are massive.

Open Solutions

So far we mostly considered outsourced commercial solutions to solve the common problems. That however is not the only approach. It would be possible to reap the same, if not more benefits from an open core model. e.g. An open source trading system, that every bank makes commits to improve only keeping closed source the parts that are uniquely valuable to their business. Unfortunately in practice so far this seems to be less viable as any entity that pushes adoption of the platform, realizes costs pushing it while not capturing much value. Whereas closed source, the company incurs the marketing costs but can get this back in licensing fees.

June 13th, 2021 by admin

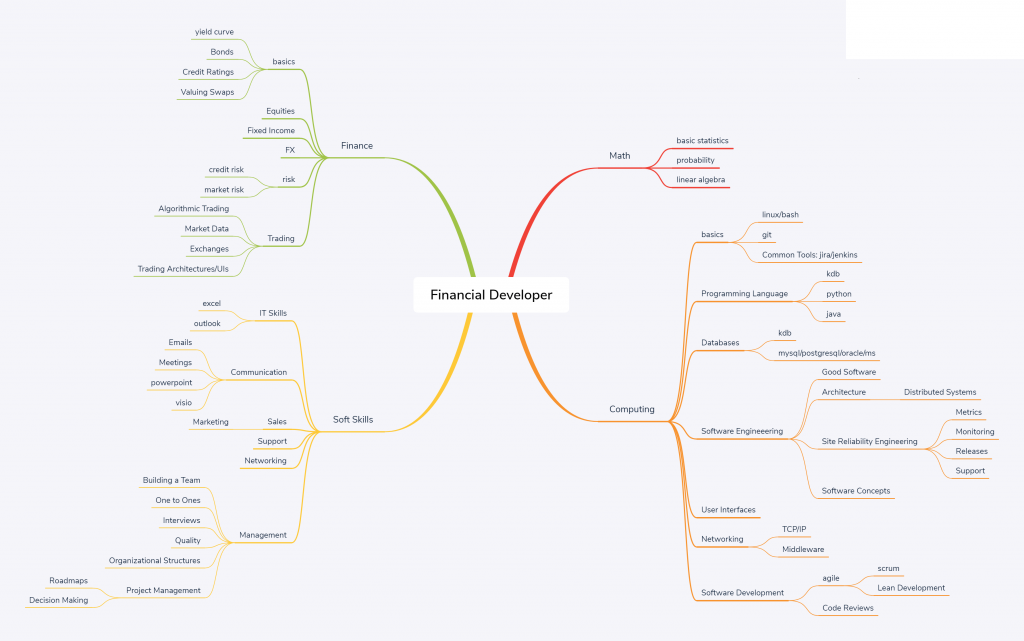

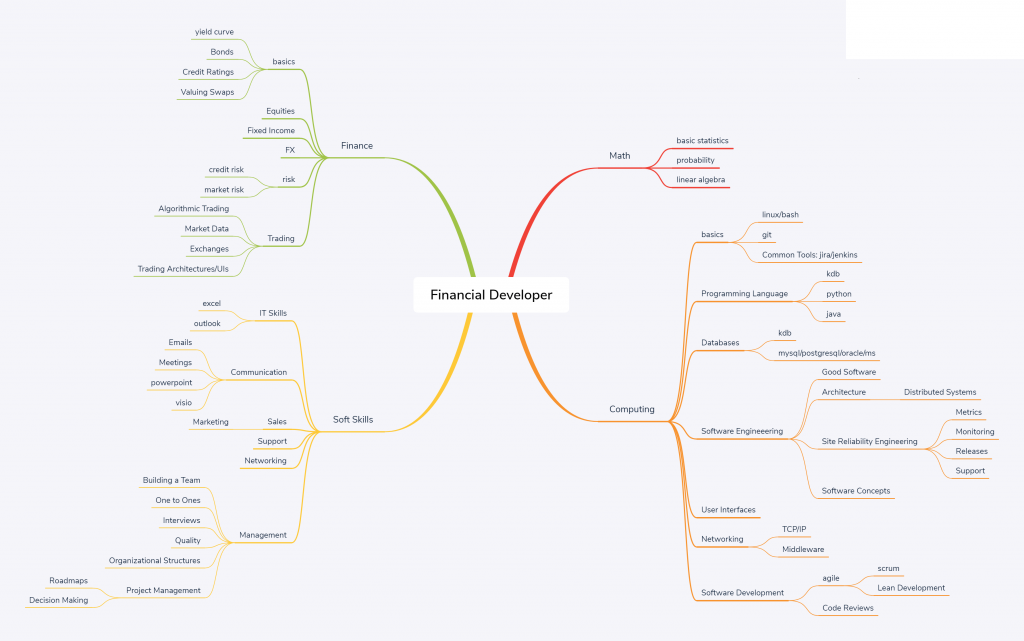

The below network diagram is intended as an outline of the skill set required for a financial software developer.

Note:

- Most individuals should aim to have a strong core. Think of it like a pyramid, where the height is the strength of a skill. Core skills like general computing principles, probability, communication should be built “tall” and very strong. peripheral skills such as python/monitoring will be weaker. An individual will typically only learn 1 or 2 niche areas strongly (T shaped)

- Notice the rough relative sizes of the areas. 55% computing, 10% math, 15% soft skills, 20% finance. This is intended to represent the rough allocation of effort.

- If you only bring 95% techinical skills, you are going to waste time building the wrong thing, build something no one wants or build something useful but no one will know as you haven’t the soft skills to sell it.

- The management branch on the bottom left is optional.

Computing

| Skill |

Topic |

Sub-Topic |

Links |

Requirement |

| basics |

|

|

|

|

| linux |

|

surrey |

Change Directories, edit config files, kill processes, copy/move files, check disk space. |

| bash |

|

tldp.org |

Write a script to periodically sync a directory between servers and schedule it using cron. |

| git |

|

git-scm |

Checkout, branch, commit, push code. |

| Common Tools: jira/jenkins |

|

user-stories |

Write a good jira, assign owner. Kick off a build on a common CD platform. |

|

|

|

|

|

| Programming Language |

|

|

|

Knowledge of 2 different programming paradigms. |

| kdb |

|

kdb-tree |

Write efficient selects for pulling back a subset of data. |

| python |

|

|

Download data from a REST api, calculate average/mean/median for certain metrics. |

| java |

|

book |

Write a java program to count the number of words in a file. |

|

|

|

|

|

| Databases |

|

|

|

Be aware of the major types of database available and when to use each. |

| kdb |

|

kdb-tree |

|

| mysql/postgresql/oracle/ms |

|

|

Know standard SQL. |

|

|

|

|

|

| Software Engineeering |

|

|

peopleware |

How to grow good software. |

| Good Software |

|

|

Properties of good software with examples. |

| Architecture |

|

|

Common Enterprise software patterns. |

| Distributed Systems |

|

Difficulties with distributed systems and common patterns to solve them. |

| Data Processing Pipelines |

|

Common processing Pipeline Patterns |

| Site Reliability Engineering |

|

SRE |

How reliable should software be? |

| Metrics |

|

Ccommon metrics used to measure reliability and when to use each |

| Monitoring |

|

What monitoring systems/tools are available? What are monitoring best practices? |

| Releases |

Accelerate |

|

| Support |

|

Handling outages. Engaging with users. |

| Software Concepts |

Testing |

|

Testing Methods and knowledge of one test framework |

|

|

|

|

|

| User Interfaces |

|

|

dont-think |

What makes a good user interface? |

|

|

|

|

|

| Networking |

|

|

|

How computers connect. Expected latency/bandwidth. |

| TCP/IP |

|

|

ports, switches, racks, data centres, windows. |

| Middleware |

|

|

Messaging midddleware: solace/JMS/kafka/MQ. |

|

|

|

|

|

| Software Development |

|

|

|

|

| agile |

|

|

|

| scrum |

book |

Sprints, iterations, standups, restrospectives, story-time. |

| Lean Development |

lean-startup |

When, why and how to develop lean. |

| Code Reviews |

|

pragma |

Code review best practices. |

Soft Skills

| Skill |

Topic |

Sub-Topic |

Links |

Requirement |

| IT Skills |

|

|

|

|

| excel |

|

|

Create a table with conditional formatting, calculate sum/average of column, use vlookup |

| outlook |

|

|

Filter emails, create meetings. |

|

|

|

|

|

| Communication |

|

|

|

|

| Emails |

|

|

How to write an email to users, team mates, managers, senior management. |

| Meetings |

|

atlassian |

What is a meeting meant to accomplish? How to achieve that. |

| powerpoint |

|

|

Prepare a presentation for management. |

| visio |

|

|

Draw an architectural diagram of your system. |

|

|

|

|

|

| Sales |

|

|

|

|

| Marketing |

|

Traction |

How to get your software used and appreciate by more users. |

| Support |

|

|

|

|

| Networking |

|

|

|

Building a network to get things done. |

|

|

|

|

|

| Management |

|

|

Grove |

|

| Building a Team |

|

Dysfunctions |

|

| One to Ones |

|

|

What makes a good one-to-one |

| Interviews |

|

|

How to evaluate cnadidates effectively. |

| Quality |

|

|

How to ensure quality of product. |

| Organizational Structures |

|

phoenix |

Different structures for management. |

| Project Management |

|

|

|

| Roadmaps |

|

|

| Decision Making |

|

Which approach to decision making to use when. |

November 25th, 2018 by admin

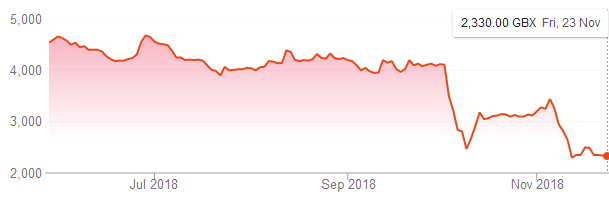

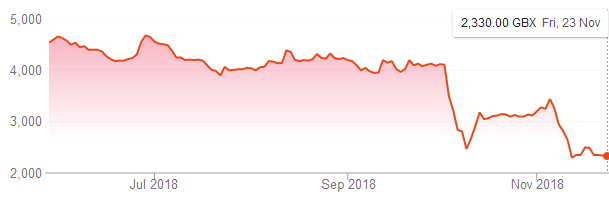

First Derivatives Shares have fell back to a price last seen in February 2017:

One cause of the fall has been a damning article by ShadowFall. Their main arguments are:

- First Derivatives was being priced highly as a software company

- It is not a software company but a consultancy.

- Previously good years were due to outside factors (property prices and government grants)

- They have made a significant investment in KX which may itself have stopped growing

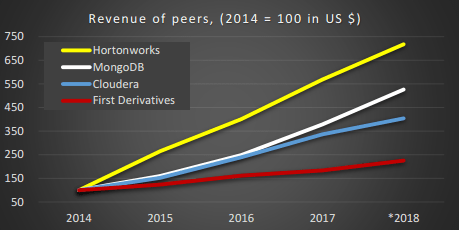

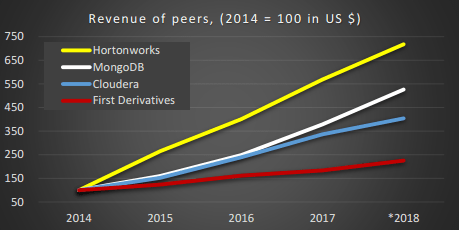

The 47 page report goes into a lot of detail, to give an idea here’s one of the charts:

He shows numerous statistics for FD compared to it’s peers, operating margin, gross margin, revenue, headcount. It’s worth a read if you have an interest in kdb/KX/FD.

Related Links: Shadowfall tweet, Independent.ie.

January 14th, 2018 by Ryan Hamilton

The structure of banks and finance firms are constantly changing as they evolve towards the structure best for todays environment. The trend over recent years has been for less traders and more engineers as expanded in this (article. (thanks Zak). In these posts I’ll describe the current state and where I think fintech, in particular market data capture and kdb are going.

(Newer firms that are) “Tech savvy, led by quants and data engineers rather than the expensive traders sitting on the scrap heap of most banks’ inferior tech, the new entrants now just need people with the skills to win over large numbers of customers.”

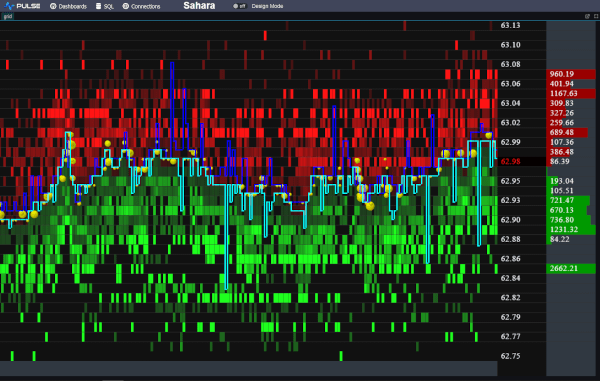

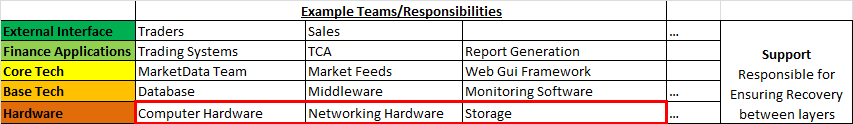

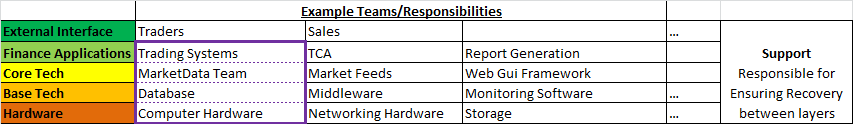

Banks as a Stack

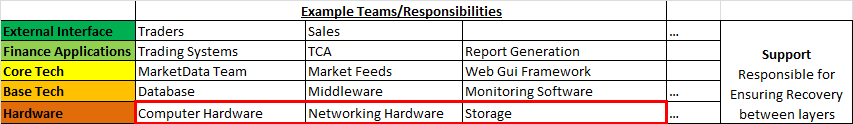

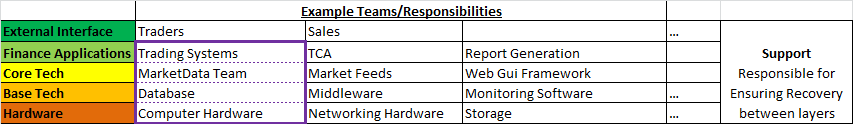

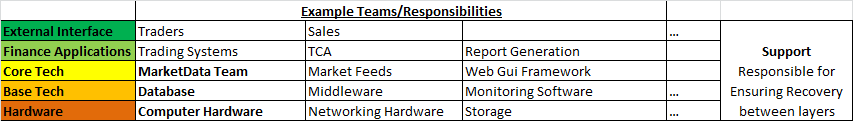

Think of banks as a stack of services sitting ontop of each other [1]:

Communication within the system is mostly between the layers. Top layers rely on all the services of the layers beneath. e.g. A trader relies on a trading application, that relies on an internal web framework, that relies on a database, that relies on hardware. If we get more traders that need additional software changes, that could transmit down the stack into a request for more hardware. Communication outside the layer model, e.g. Sales asking for additional SAN storage is exceedingly rare.

Within the stack, I’ve highlighted in bold where market data capture sits. I believe most the points I’ll make can be applied wider to other areas within the stack but I’ll stick to examples within the area I know. Sometimes the “market data” team will include responsibility for Feeds, sometimes there will be a core team responsible for the database software they use, sometimes there won’t, but it captures the general structure.

Issues with the current Stack

Note each box on the diagram I refer to as a silo. A silo may be one team, multiple teams or a part of a team but generally it’s a group responsible for one area, looking after it’s own goals.

- Communication between silos is slow – Currently communication between silos consist of meetings, phone calls and change tickets. Getting anything done quickly is a nightmare. [2]

- Duplication of Effort – The simplified model above can often be heavily duplicated. e.g. FX, Equities, Fixed income may have separate teams responsible for delivering very similar goals. e.g. An FX Web GUI team, An equities Web GUI team. Losing all benefit of scale. [3]

- Misalignment of Incentives – Each silo has it’s own goals which often do not align with the overall goals of the layers above or below. e.g. The database team

may be experts in Oracle, even if an application team thinks MongoDB is the solution for their problem, the database team are not incentivised to supply/suggest/support that solution.[4]

- Incorrectly Sized Layers – At any time, certain silos or layers within the stack will have too many or too few resources. The article linked at the top of this post suggests the layers should be a pyramid shape, i.e. Very few sales/traders to meet todays electronic market needs. We should be able to contract/expand silos dynamically as required.

Possible Solutions coming in 2018

There are a number of possible solutions to the issues above available today, unfortunately I will have to expand on that in a future post. I am very interested in hearing others views.

Do you believe the stack and issues highlighted are an accurate representation? Solutions you see coming up? Either comment below or drop me an email.

I will hopefully post [part 2] shortly, if you want notified when that happens, sign up to our mailing list.

Notes:

- For some reason this reminds me of the OSI 7 layer model.

- Amazon try to escape this communication overhead by making everything an API

- Customers may prefer a bank that supplies all services but divisions within banks are too big to enforce conformity. Both limitations likely due to Dunbar Number

- Even within a single team, the modern workplace may create conflicting loyalties.