2018 – The Future of Tech in Banks, particularly Market Data (Part 1)

The structure of banks and finance firms are constantly changing as they evolve towards the structure best for todays environment. The trend over recent years has been for less traders and more engineers as expanded in this (article. (thanks Zak). In these posts I’ll describe the current state and where I think fintech, in particular market data capture and kdb are going.

(Newer firms that are) “Tech savvy, led by quants and data engineers rather than the expensive traders sitting on the scrap heap of most banks’ inferior tech, the new entrants now just need people with the skills to win over large numbers of customers.”

Banks as a Stack

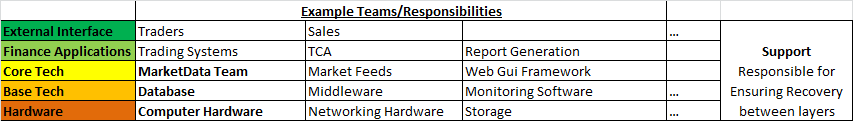

Think of banks as a stack of services sitting ontop of each other [1]:

Communication within the system is mostly between the layers. Top layers rely on all the services of the layers beneath. e.g. A trader relies on a trading application, that relies on an internal web framework, that relies on a database, that relies on hardware. If we get more traders that need additional software changes, that could transmit down the stack into a request for more hardware. Communication outside the layer model, e.g. Sales asking for additional SAN storage is exceedingly rare.

Within the stack, I’ve highlighted in bold where market data capture sits. I believe most the points I’ll make can be applied wider to other areas within the stack but I’ll stick to examples within the area I know. Sometimes the “market data” team will include responsibility for Feeds, sometimes there will be a core team responsible for the database software they use, sometimes there won’t, but it captures the general structure.

Issues with the current Stack

Note each box on the diagram I refer to as a silo. A silo may be one team, multiple teams or a part of a team but generally it’s a group responsible for one area, looking after it’s own goals.

- Communication between silos is slow – Currently communication between silos consist of meetings, phone calls and change tickets. Getting anything done quickly is a nightmare. [2]

- Duplication of Effort – The simplified model above can often be heavily duplicated. e.g. FX, Equities, Fixed income may have separate teams responsible for delivering very similar goals. e.g. An FX Web GUI team, An equities Web GUI team. Losing all benefit of scale. [3]

- Misalignment of Incentives – Each silo has it’s own goals which often do not align with the overall goals of the layers above or below. e.g. The database team

may be experts in Oracle, even if an application team thinks MongoDB is the solution for their problem, the database team are not incentivised to supply/suggest/support that solution.[4] - Incorrectly Sized Layers – At any time, certain silos or layers within the stack will have too many or too few resources. The article linked at the top of this post suggests the layers should be a pyramid shape, i.e. Very few sales/traders to meet todays electronic market needs. We should be able to contract/expand silos dynamically as required.

Possible Solutions coming in 2018

There are a number of possible solutions to the issues above available today, unfortunately I will have to expand on that in a future post. I am very interested in hearing others views.

Do you believe the stack and issues highlighted are an accurate representation? Solutions you see coming up? Either comment below or drop me an email.

I will hopefully post [part 2] shortly, if you want notified when that happens, sign up to our mailing list.

Notes:

- For some reason this reminds me of the OSI 7 layer model.

- Amazon try to escape this communication overhead by making everything an API

- Customers may prefer a bank that supplies all services but divisions within banks are too big to enforce conformity. Both limitations likely due to Dunbar Number

- Even within a single team, the modern workplace may create conflicting loyalties.