October 20th, 2014 by admin

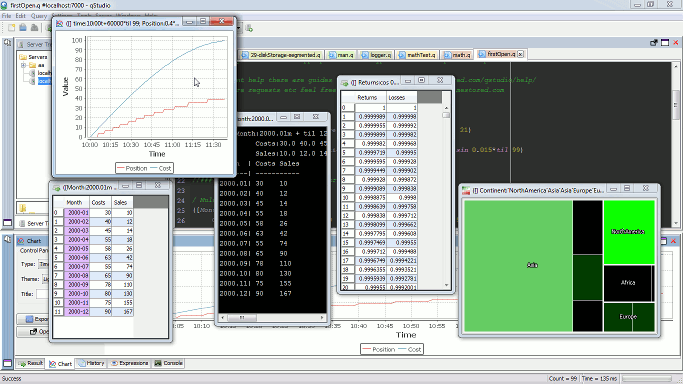

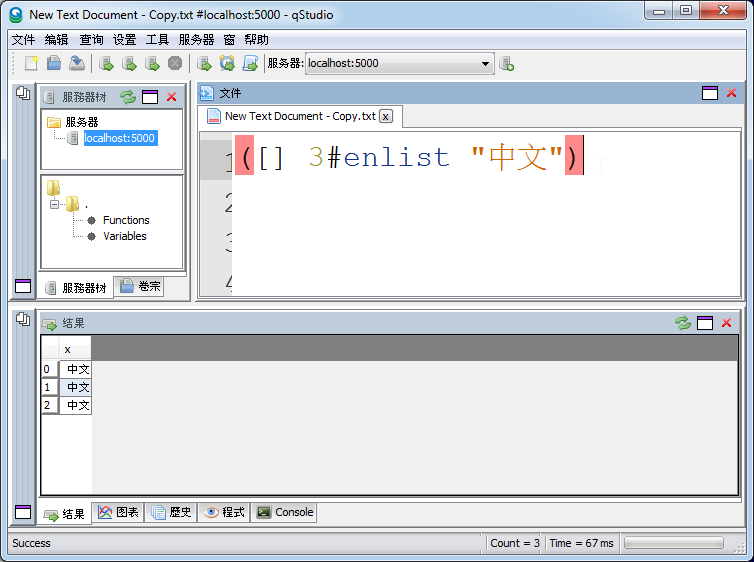

Based on user requests we have released a number of new features with qStudio 1.36:

Download the latest ->qStudio<- now.

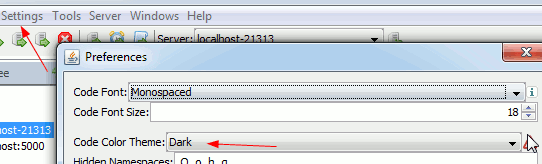

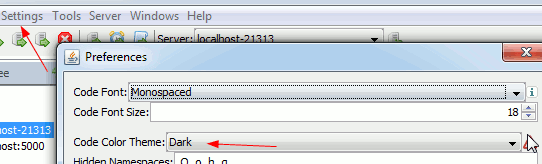

Dark Code Editor Themes

Which can be set under settings->preferences

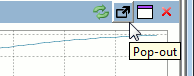

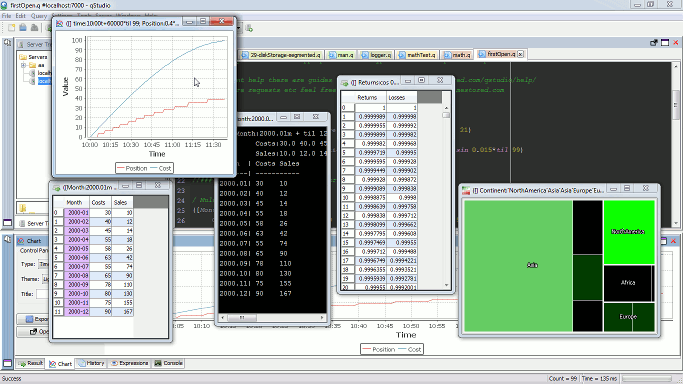

Open Results and Charts in New Window

To expand a panel into a new window click the “pop-out” icon.

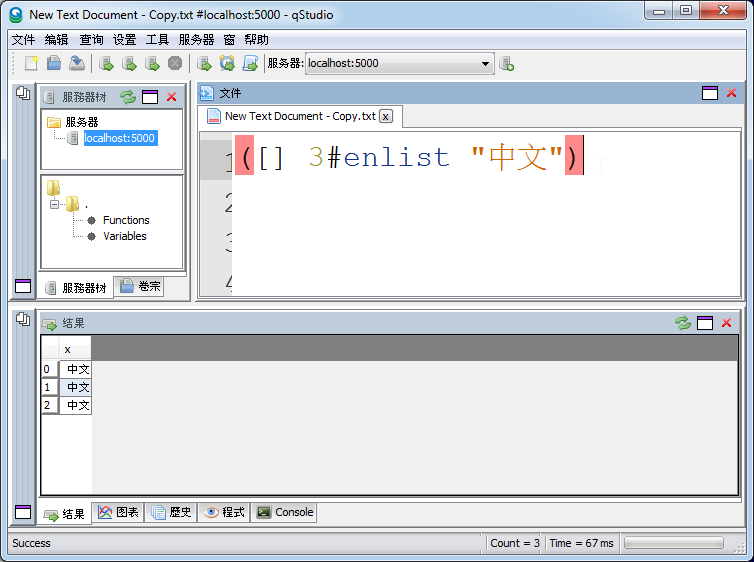

This will bring up the result in a new window:

UTF-8 Chinese Language Support

October 20th, 2014 by admin

Newry-based financial software firm First Derivatives has acquired a majority shareholding in big data analytics company Kx Systems for £36m (€44m).

KX has historically had a hard time penetrating markets outside finance, FD have a good sales team and previously acquired a marketing company in Philadelphia, hopefully this is the chance for kdb+ to go mainstream.

However it’s a worry that FD (First Derivatives) may increasingly “encourage” purchasing of the delta platform bundle rather than stand-alone kdb+. With the smaller margins outside of finance, will FD take a risk and open up the database. (Would FD have been a supporter of the 32-bit version becoming free for commercial use?) There’s a large number of individuals in off-shore locations that want to learn kdb+, FD could be incentivized to discourage that as it would hurt their consulting business.

It’s also interesting to consider companies that have already invested in KX technology and whether they will continue to do so

- Competing consulting firms that specialise in kdb+ won’t take this as good news.

- Panopticon/Datawatch based their visualization system on kdb+ (OEM license), they probably regret that now, given that their visualization software directly competes with FD’s dashboards.

- Companies that had used kdb+ as part of their trading platform stack may consider FD a competitor as they also offer a trading platform.

What do you think? Will this lead to wider adoption? a growing platform?

October 8th, 2014 by admin

kdb+ London Contract – £800 p/day

kdb+ belfast Citigroup Contract £400 p/day

Java Poland £150 p/day